Operations & Infrastructure

Among the world's most significant gold projects with an anticipated 27 year life.

Mine Operations

Donlin Gold is expected to be a conventional open pit, truck-and-shovel operation. Mining is expected to occur over 26 years, inclusive of one year of pre-stripping. The process plant will be fed with stockpiled low-grade ore for two additional years following the completion of mining. Peak production rates are expected to reach 155 million tonnes per year (425,000 tonnes per day). The mining equipment required includes large hydraulic shovels, front-end loaders, ultra-class haul trucks, rotary blast hole drills, and various support equipment including track dozers, wheel dozers, graders, water trucks, and excavators.

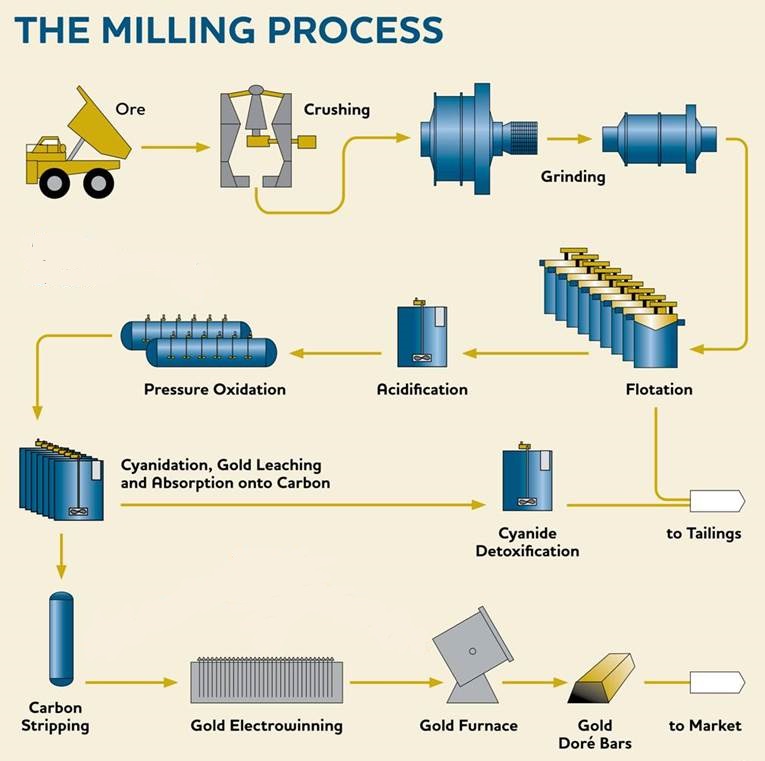

Metallurgy and Processing

The run-of-mine (ROM) ore from the Donlin Gold deposit will be crushed in a gyratory crusher and then milled using semi-autogenous grinding (SAG) and two-stage ball milling. Average throughput is expected to be 53,500 tonnes per day. The gold-bearing sulphides will be recovered by flotation to produce a 7% sulphur concentrate representing around 15% of the original mass with an average gold grade of approximately 13 g/t. The concentrate is refractory and will be pre-treated in a pressure oxidation circuit (autoclave) prior to cyanidation (Carbon-In-Leach). Overall gold recovery from flotation, pressure oxidation and cyanidation is estimated at 89.8%. Excess acid from the autoclave circuit will be neutralized with flotation tailings and slaked lime. Prior to being combined with flotation tails, CIL tails will be detoxed. All tailings from this process will be impounded in the tailings storage facility. During operations, water will be reclaimed for re-use in the process plant.

The run-of-mine (ROM) ore from the Donlin Gold deposit will be crushed in a gyratory crusher and then milled using semi-autogenous grinding (SAG) and two-stage ball milling. Average throughput is expected to be 53,500 tonnes per day. The gold-bearing sulphides will be recovered by flotation to produce a 7% sulphur concentrate representing around 15% of the original mass with an average gold grade of approximately 13 g/t. The concentrate is refractory and will be pre-treated in a pressure oxidation circuit (autoclave) prior to cyanidation (Carbon-In-Leach). Overall gold recovery from flotation, pressure oxidation and cyanidation is estimated at 89.8%. Excess acid from the autoclave circuit will be neutralized with flotation tailings and slaked lime. Prior to being combined with flotation tails, CIL tails will be detoxed. All tailings from this process will be impounded in the tailings storage facility. During operations, water will be reclaimed for re-use in the process plant.

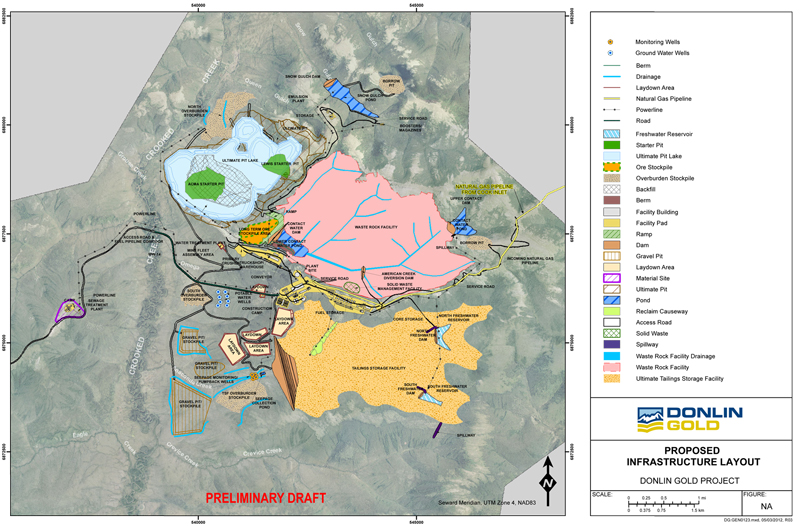

Supporting Infrastructure

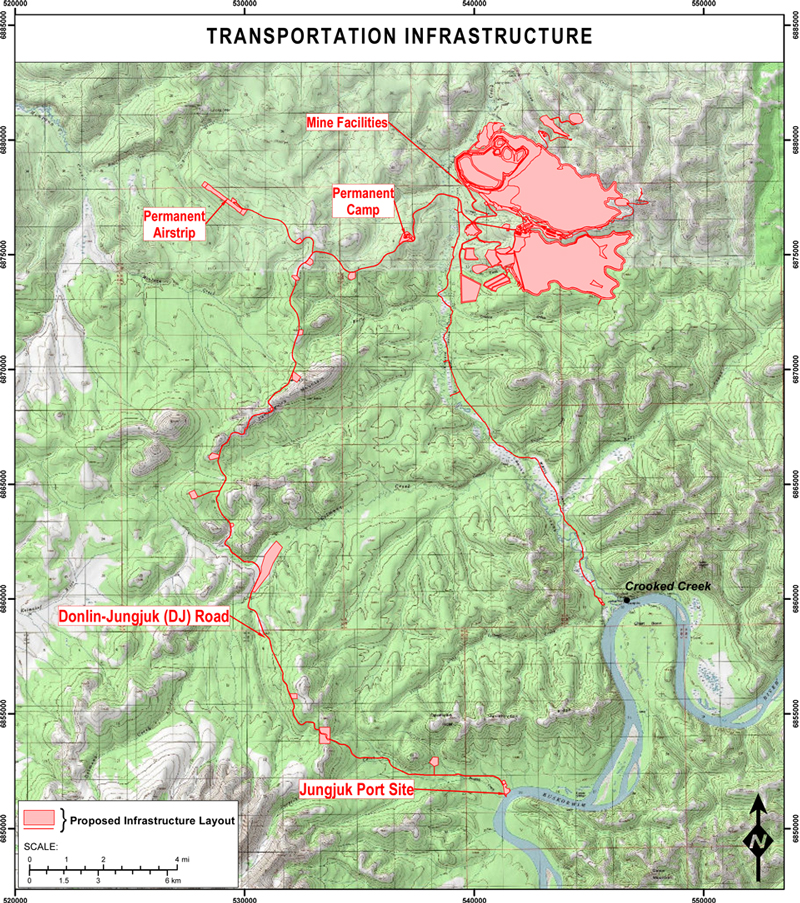

Due to the remote location of Donlin Gold, infrastructure required to support the mine and process operations include a marine cargo port near Bethel, an upriver port near Jungjuk Creek, ocean and river barging operations, an access road from the upriver port to site, a permanent camp, an airstrip, power generation facilities, fuel storage facilities, water management facilities, and a natural gas pipeline.

Due to the remote location of Donlin Gold, infrastructure required to support the mine and process operations include a marine cargo port near Bethel, an upriver port near Jungjuk Creek, ocean and river barging operations, an access road from the upriver port to site, a permanent camp, an airstrip, power generation facilities, fuel storage facilities, water management facilities, and a natural gas pipeline.

Natural Gas Pipeline

Donlin Gold is proposing to build a buried natural gas pipeline to serve as the energy source for on-site power generation. The 315 mile-long (507-kilometer-long), 14-inch-diameter (356 mm) steel pipeline would transport natural gas from the Cook Inlet region to the project site.

This natural gas pipeline is a better economic alternative over the life of mine to the previously considered barging of diesel fuel. Operating costs assume a delivered gas pricing which includes importing liquefied natural gas (LNG) to Anchorage; total delivery costs associated with purchase, transportation, and regasification of the LNG; delivery through the Cook Inlet pipeline network (existing 20-inch-diameter (508mm) natural gas pipeline near Beluga); and operating costs for the Cook Inlet-to-Donlin Gold pipeline.

Capital Cost Estimate

The total estimated cost to design and build the Donlin Gold project, is $7.4 billion per the the NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA, effective June 1, 2021 and the S-K 1300 Technical Report Summary on the Donlin Gold Project, Alaska, USA, November 30, 2021.

The total estimated cost to design and build the Donlin Gold project, is $7.4 billion per the the NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA, effective June 1, 2021 and the S-K 1300 Technical Report Summary on the Donlin Gold Project, Alaska, USA, November 30, 2021.

Sustaining Capital Cost Estimate

The sustaining capital cost estimate for the life of the mine totals $1.7 billion, or $57 per ounce of gold sold.

OPERATING COST ESTIMATE

Operating costs at Donlin Gold, estimated in the NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA, are generally categorized into mining, processing, general and administrative (G&A), and land & royalty payments. Mine operating costs are expected to total approximately $8.4 billion over the life of mine (LOM), or $2.58 per tonne mined. Process operating costs are expected to total $6.9 billion over the LOM, or $13.70 per tonne processed. G&A costs are expected to total $1.8 billion over the LOM, or $3.49 per tonne processed. Royalty and land use costs are expected to total $2.2 billion over the LOM at a gold price of $1,500 per ounce. Total operating costs over the LOM are estimated to be $19.3 billion or $38.21 per tonne processed or $635 per gold ounce sold (based on LOM operating costs of $19.2 billion and 30.4 million ounces of gold sold). Significant drivers of operating costs include diesel fuel, natural gas (for generating electric power), labor, processing reagents and consumables, explosives, tires, fixed and mobile maintenance supplies, and consulting and contracting services.

Footnotes

Source: Donlin Gold Project NI 43-101 Technical Report entitled "NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA" effective June 1, 2021 and the “S-K 1300 Technical Report Summary on the Donlin Gold Project, Alaska, USA”, November 30, 2021. A copy of the Donlin Gold Technical Report is available here as well as at www.sedar.com or www.sec.gov.